The World Is Your Market: Invest Like It

This article outlines the differences between two index funds – one Australian and one international. It discusses the benefits to be gained from diversification through investing in overseas share markets.

Despite a slowdown in Australian economic and productivity growth in the last five years, Australia’s economy is usually considered strong and resilient when compared with other developed nations. Given our economic strength, why would anyone want to invest anywhere else?

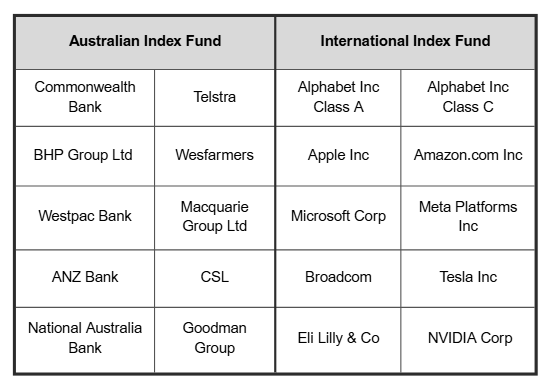

To answer this question, let’s consider what stocks might be included in a share portfolio with an international focus.

For simplicity purposes, we will look into the portfolios of a leading provider of index managed funds and their top 10 holdings. These funds tend to be passively rather than actively traded, and seek to reflect their chosen share index over the medium-to-long term.

Firstly, let’s look at the variety of industry sectors across the two portfolios. In its top ten investments, the Australian index fund holds our big four banks, plus a financial services group, a mining company, a biotechnology company, a retailer, a telecommunications company and an industrial and logistics property group.

Interestingly, the international fund shows the types of companies and industries you may be missing out on by limiting your choice to the local market. This list includes the world’s two largest IT companies and a huge pharmaceutical provider, along with interactive media companies, semiconductor manufacturers and an enormous online retailer.

In addition, these two types of funds demonstrate how concentrated the Australian market is at the top. For example, the Commonwealth Bank makes up about 10% of the local share market by capitalisation and, consequently, has a similar position in share funds like the one noted above (11% of net assets). Further, the Australian fund has almost half its money invested in just those top 10 companies.

By comparison, the biggest holding in the international fund – Apple – has less than 5% of the fund invested in it, while the top 10 make up only 23% of the portfolio.

Talk to the Experts

There are many other ways to approach global investing. If you would like to learn more about this area, talk to your financial adviser for more detailed insights.